Own Real World Assets with a Single Tap

Use Apple Pay to pick up fractional stakes in income-producing real estate, private equity, and invoice factoring

Four Yield Engines, One App

Tokenized invoices, data centers, private-equity shares, and Global Real Estate—all in one place for instant diversification.

Tokenized invoices, data centers, private-equity shares, and Global Real Estate—all in one place for instant diversification.

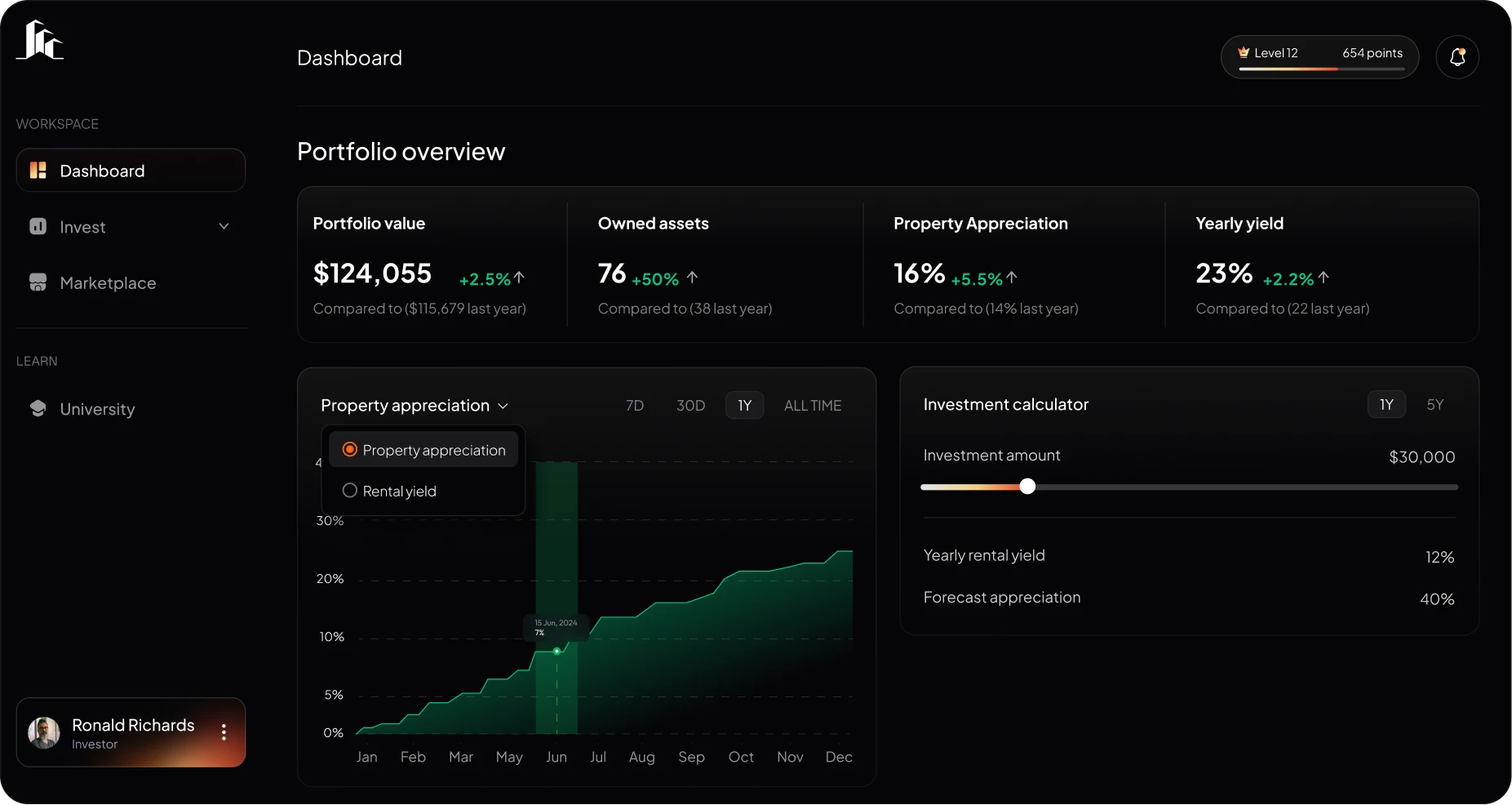

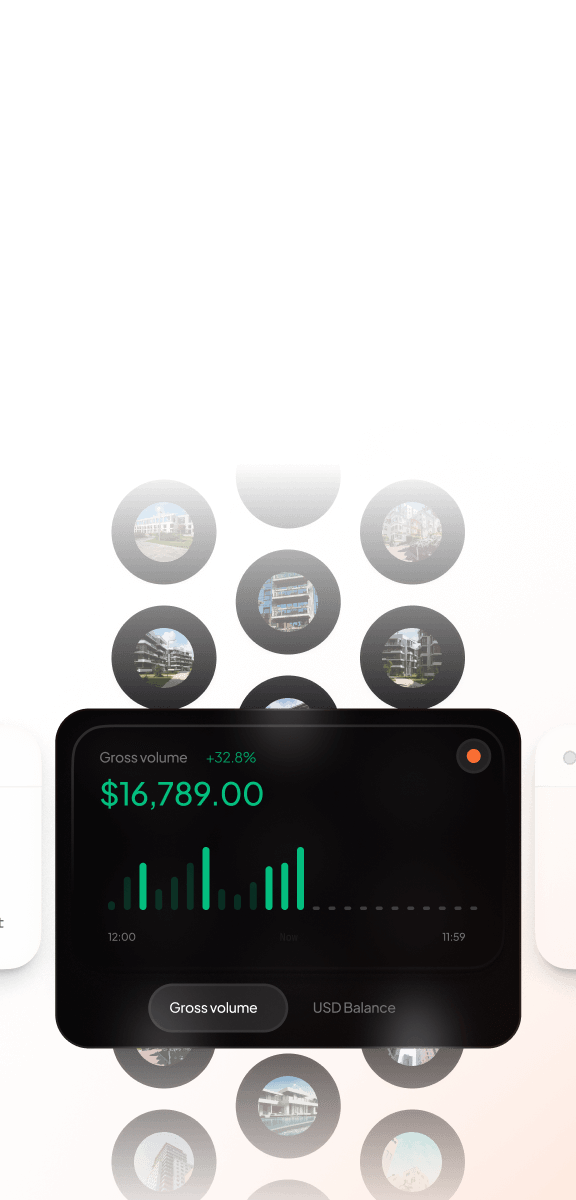

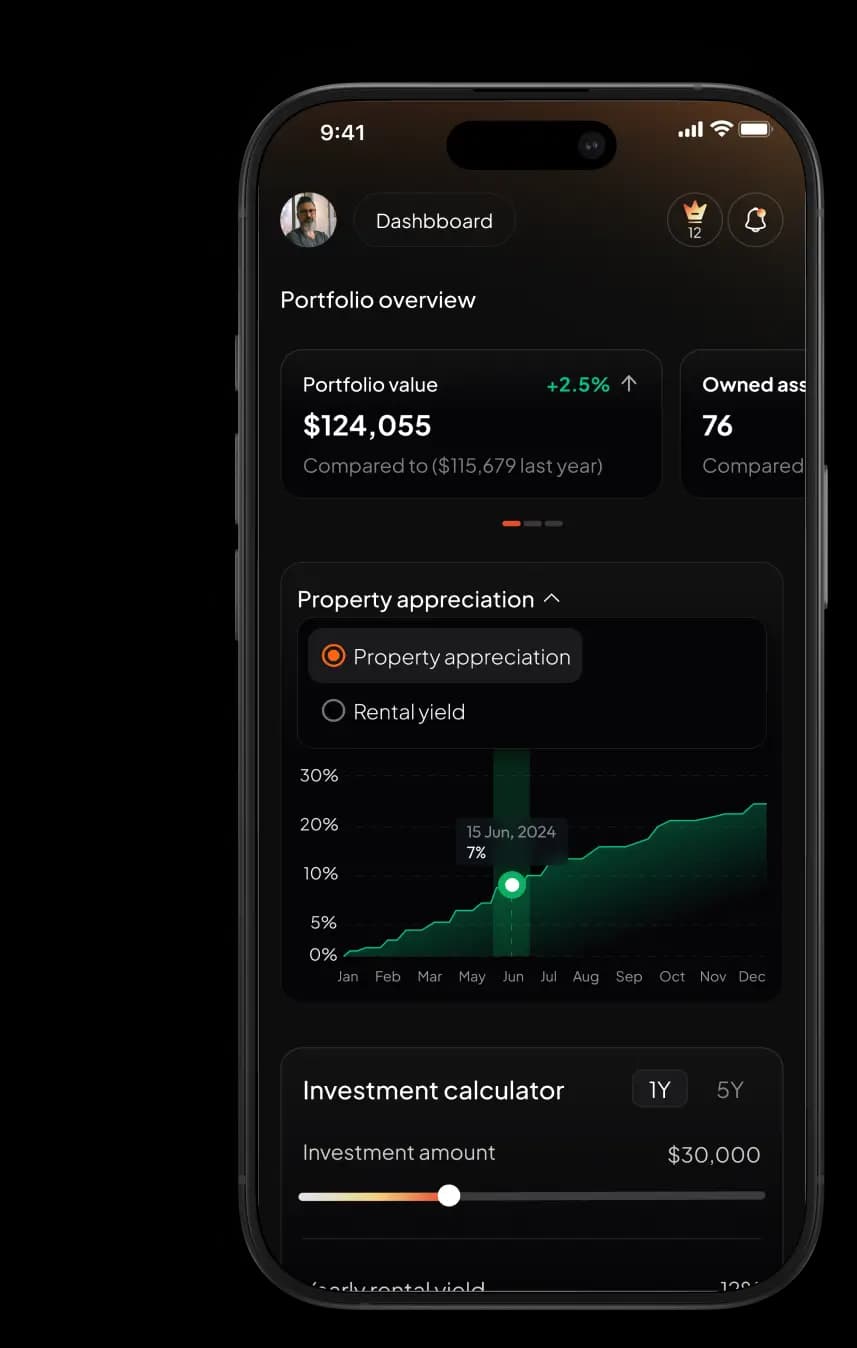

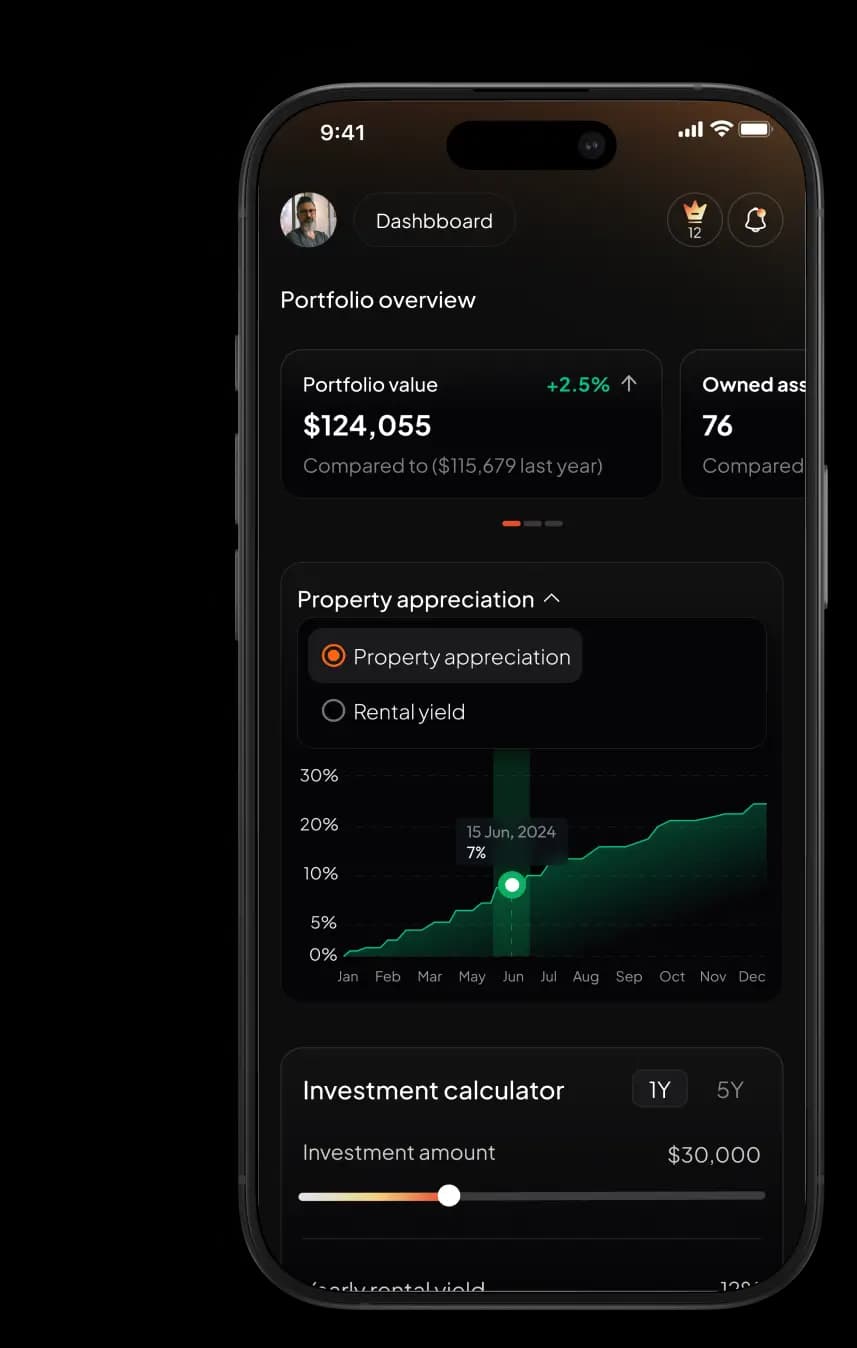

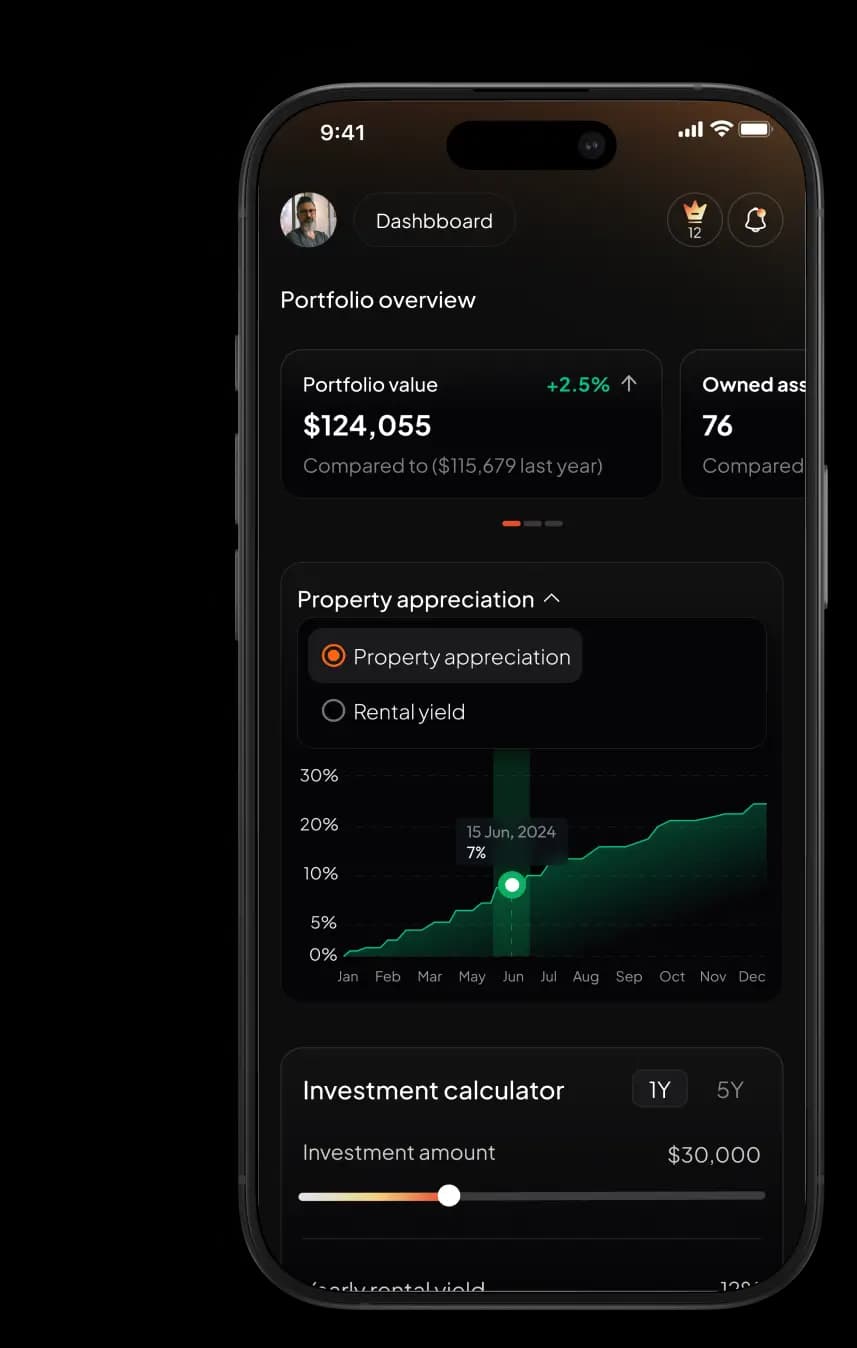

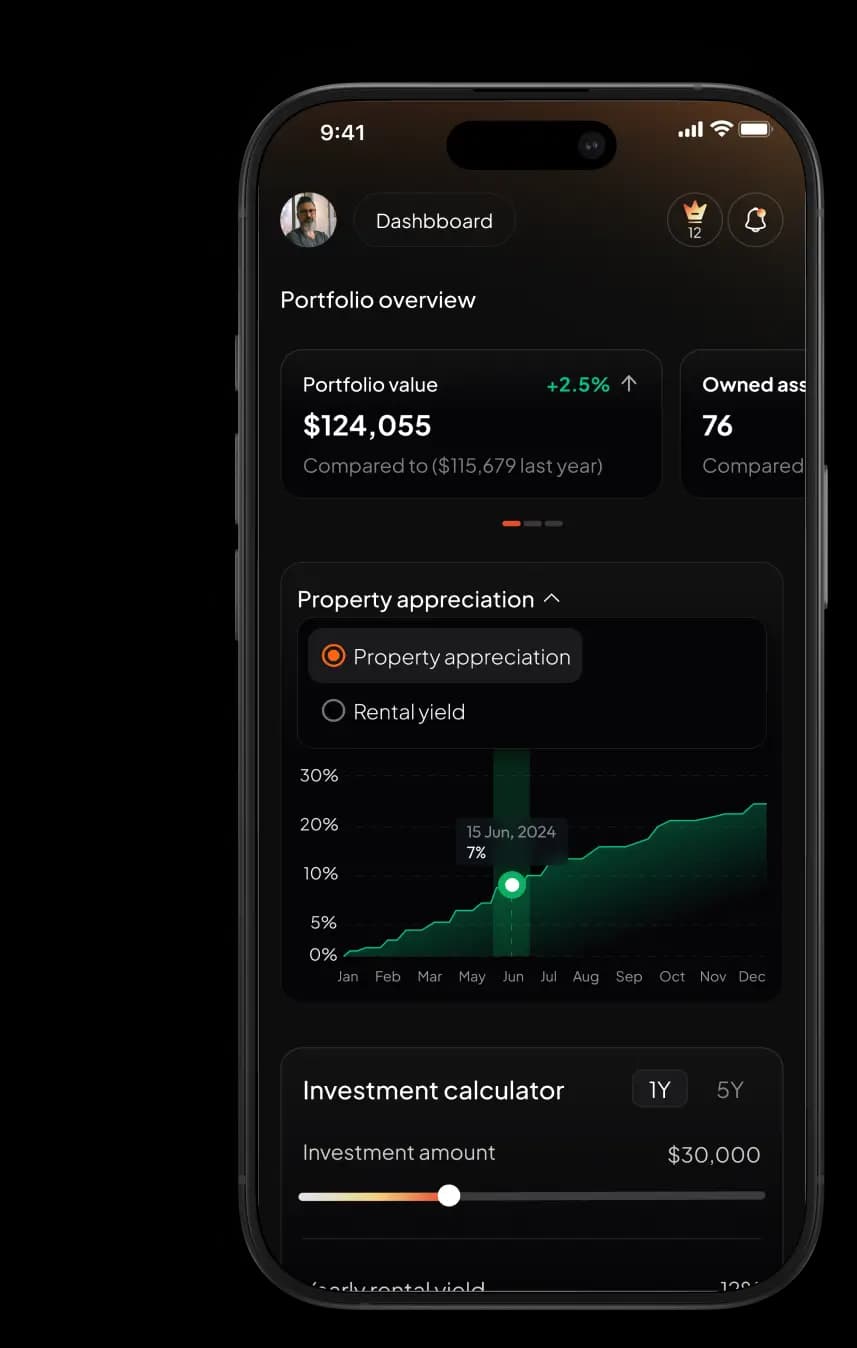

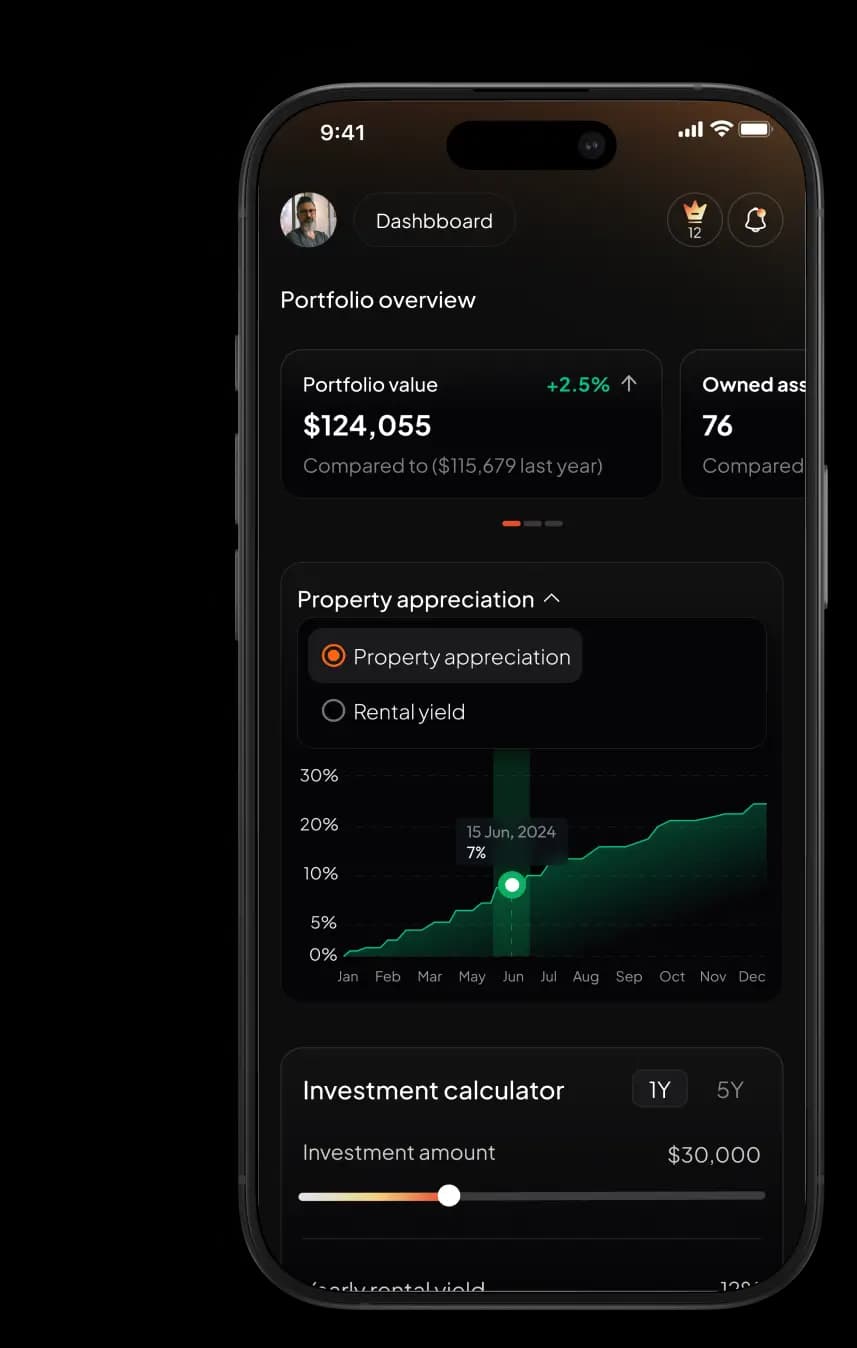

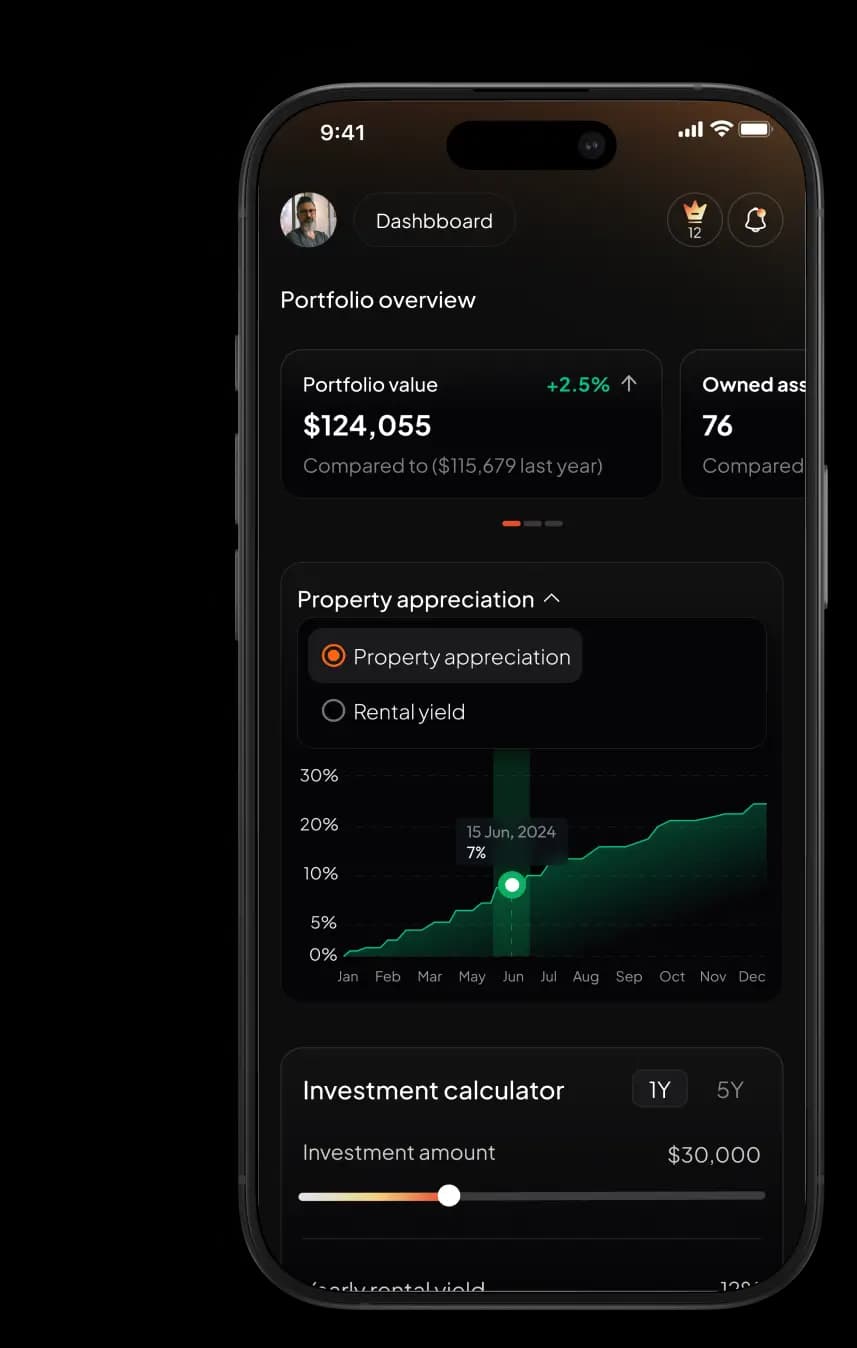

One App for All Your Real-World Assets

Track and manage invoice factoring, data-centre leases, private-equity stakes, and property holdings from one streamlined dashboard.

Explore our products

Digital Factoring

Cash-Flow

Invest in tokenized 30–90 day invoice notes and earn fixed income backed by Allianz-insured receivables covering up to 98 % of principal.

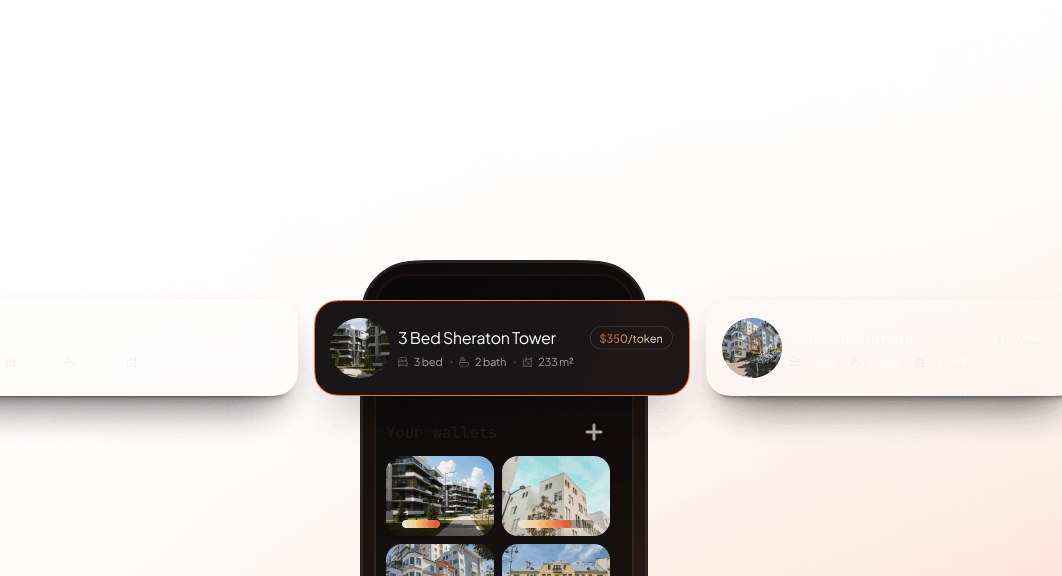

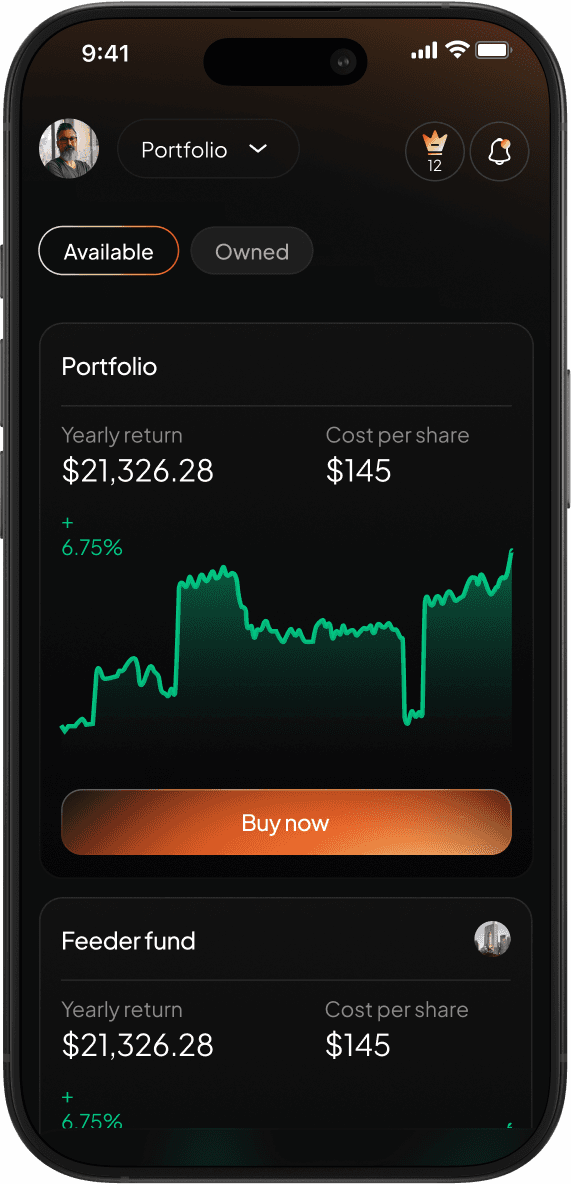

Global Real Estate

Own a landmark building or spread your stake across a fund of prime homes and offices—earning steady rent and long-term appreciation.

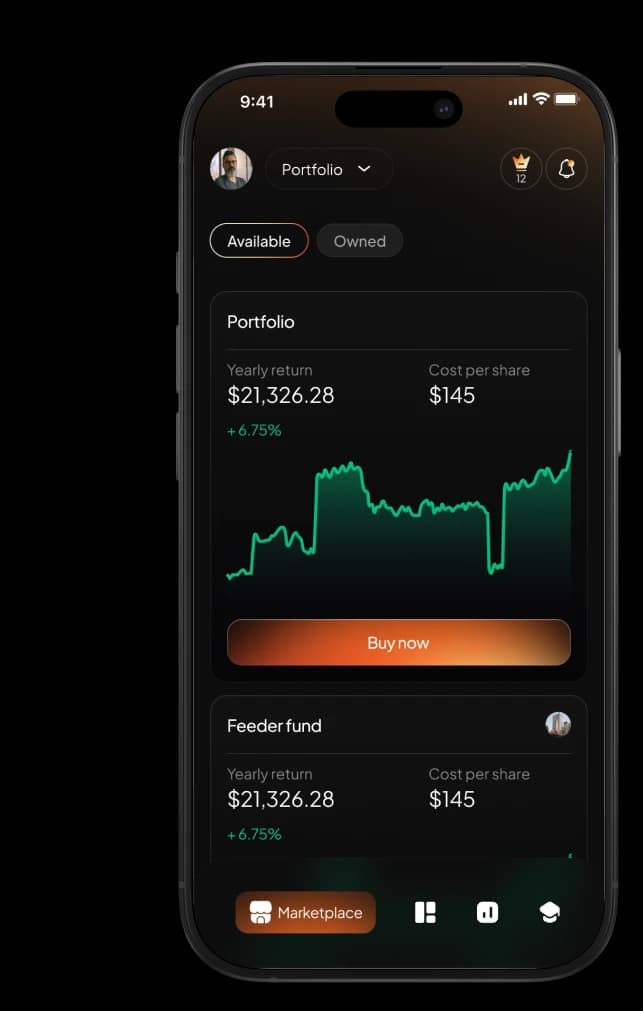

Private-Equity Access

Tap into top-tier private-equity funds through on-chain feeder vehicles, getting diversified buy-out exposure at a fraction of the usual entry cost.

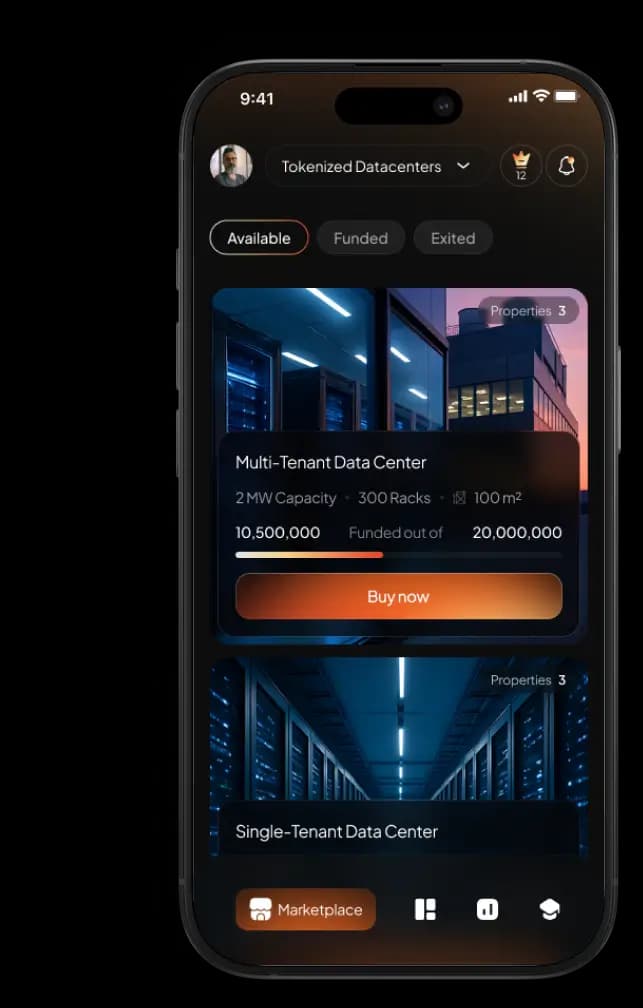

Tokenized Data-Center Infrastructure

Invest fractionally in hyperscale data-centres that power AI and cloud, earning long-term cash-flows tied to their leases.

P2P Marketplace

Explore our peer-to-peer marketplace, enabling the buying and selling of tokenized real estate with ease.

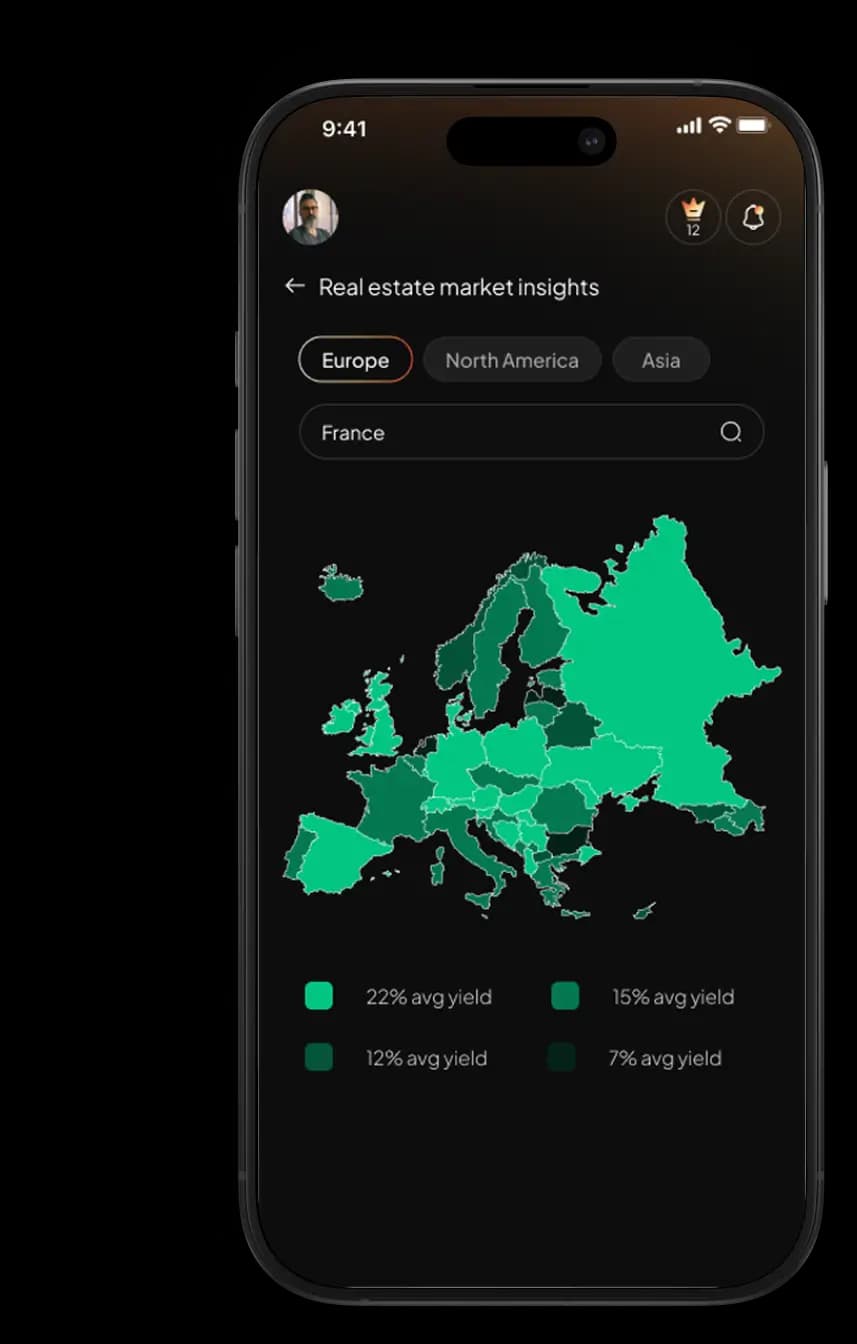

AI-Powered Market

Insights

Use cutting-edge AI analytics to make data-driven investment decisions based on real-time market trends.

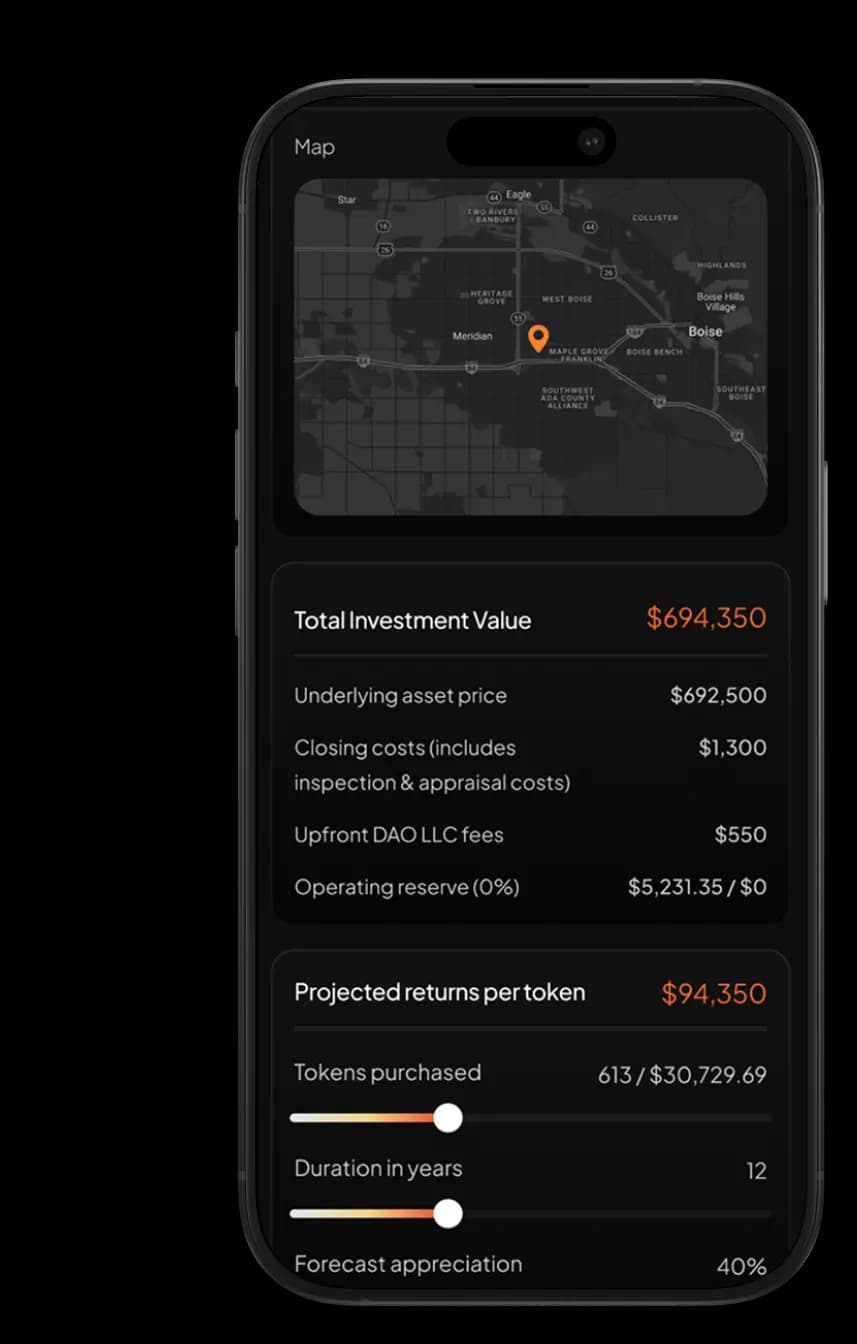

Invest in Tokenized Real-World Assets

Buy, track, and rebalance invoice notes, data-center leases, private-equity tokens, and global property stakes from a single dashboard—no extra wallets, logins, or spreadsheets.

Invest in Tokenized Real-World Assets

Buy, track, and rebalance invoice notes, data-center leases, private-equity tokens, and global property stakes from a single dashboard—no extra wallets, logins, or spreadsheets.

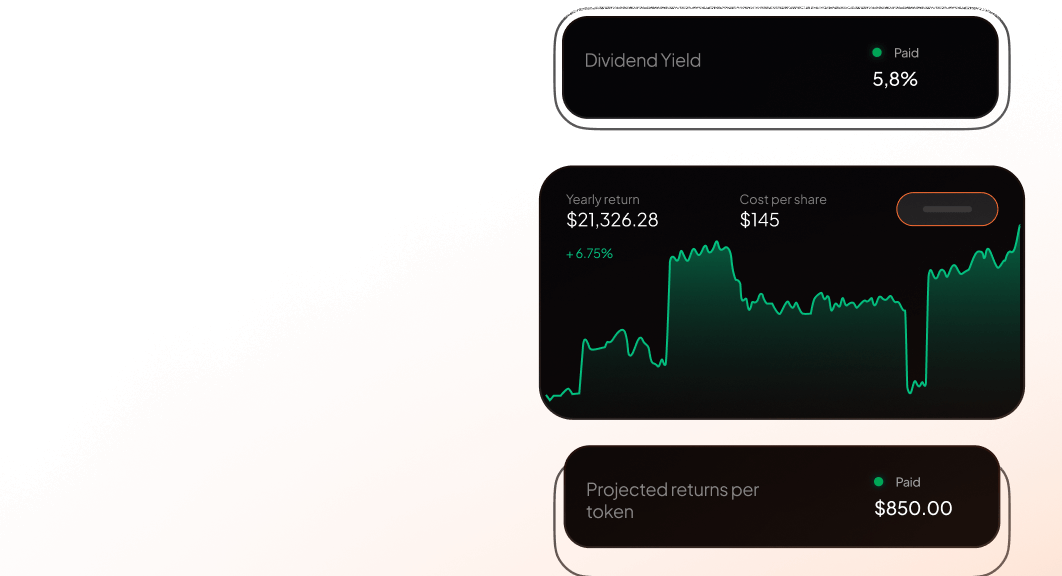

Crystal-Clear Returns, Effortless Payouts

Every rent, interest, and profit payment is recorded on-chain and automatically deposited to your wallet. Yield allocated instantly and without any aditional paperwork.

Powerful intelligence, all in one app

Our engine digests global headlines, macro data, and on-chain activity around the clock and surfaces clear buy, hold, and exit cues, so every tap you make is a step ahead of the market.

Data-Driven Portfolio Decisions

Interactive dashboards translate rent rolls, invoice histories, and private-equity metrics into simple risk-return scores, helping you rebalance or cash out with confidence, no spreadsheets required.

Global Yield Heatmap

A live world map highlights where tokenized real-world assets on Yield Hive deliver the best risk-adjusted returns. It guides you to deploy capital in the safest, highest-yield markets.

Global Real Estate Investing at your fingertips

Why Invest in Real‑World Assets With Yield Hive

Institutional-Grade Deals, Curated for You

Expert Vetting & Due Diligence

Every invoice pool, data-centre lease, private-equity stake, and property faces a full legal, financial, and on-chain audit before it reaches the app. If an asset doesn’t clear every hurdle, it never makes the shelf.

Securitized SPV Structures

Each vetted asset lives inside a securitised, bankruptcy-remote SPV, insulating your claim from issuer risk and keeping every payout on-schedule and compliant.

Seamless Investing & Yield Automation

Borderless Capital Access

Yield Hive links asset issuers to a worldwide pool of individual and institutional backers, so raises fill faster and marketing spend stays lean.

Automated Returns & Liquidity

Smart contracts stream cash-flows and profit-shares straight to your wallet, while quarterly redemptions and an active secondary market let you unlock value on your schedule.

STO Issuance Process

Powered by our Token

Exclusive access to prime property details

Access AI Market Intelligence

Angel Investors & Advisors

Lynn Oliver

CEO Lorem

Lynn Oliver

CEO Lorem

Lynn Oliver

CEO Lorem

Lynn Oliver

CEO Lorem

Project Roadmap

Phase 1

Q2 - Completed Pre-Seed Round

Secured initial capital for technology development and platform setup. Built relationships with early investors and allocated funds for marketing.

Phase 2

Q3 - Platform Alpha Development,

Team Expansion and Partnerships

Built blockchain infrastructure and smart contracts. Expanded core team and secured partnerships for exclusive real estate access.

Phase 3

Q4 - MVP Testing, UI/UX Enhancements,

Network Growth, Whitepaper Release

Conducted MVP testing and gathered user feedback to refine features. Expanded network and released a detailed whitepaper.

Phase 4

Q1 - MVP Launch & Compliance

Launched MVP, onboarded issuance partners, and finalized global regulatory compliance.

Phase 5

Q2 - TGE & User Acquisition

Expanded issuance partners, launched user acquisition campaigns, executed TGE, and introduced staking.

Phase 6

Q3 - Feeder Fund Launch & Platform Scaling

Launched the first feeder fund, expanded property listings, upgraded dashboards, and onboarded institutional investors.

Phase 7

Q4 - Opportunistic Fund & Advanced Analytics

Launched the second feeder fund, introduced market analytics tools, and expanded issuance partnerships.

Phase 8

H1 – Development Fund & DAO Launch

Introduced a real estate development fund, launched DAO governance, and started a token buyback program.

Phase 9

H2 - P2P Marketplace & DAO Integration

Launched a P2P secondary market, integrated DAO legal frameworks, expanded platform tools, and enhanced security.

What news about Crypto

More Asked Questions

We've compiled a list of the most frequently asked questions to help you understand its features and benefits.

- Stable Yield Fund: Focused on income-generating properties with steady rental yields.

- Opportunistic Fund: Targets high-potential, early-stage real estate developments for higher returns.

- Off-Plan Fund: Invests in discounted properties under construction with strong growth potential.

- Residential and commercial properties.

- Industrial and infrastructure assets.

- Off-plan and development-stage properties.

- Tokenized funds for broader diversification.